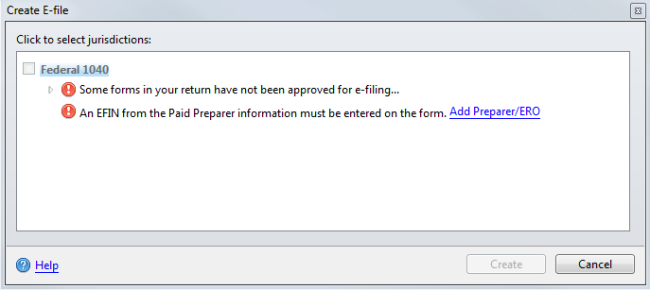

Create E-file Dialog Box

The Create E-file dialog box allows you to select the returns (state and/or Federal) that you want to e-file. It has built-in IRS business knowledge that gives you an error, warning, or informational message when missing data or forms in the return may prevent you from e-filing.

The Create button only becomes enabled when you resolve these e-file related errors.

Create E-file Messages

The following messages may appear when you create e-files:

|

Create E-file Messages |

Message Description |

|---|---|

|

There are required forms missing from your return |

Click the left arrow to reveal the name of the missing form. Click the Add required forms link to add the required forms to the return. The required form tabs will appear at the top of the page. |

|

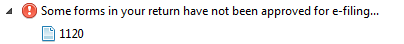

Some forms in your return have not been approved for e-filing |

Displays if forms associated with the return are not yet approved for e-filing. Click the arrow to the left of the message to show the form. (You cannot correct this until the form becomes available.)

|

|

Form X is required but has some errors or warnings of its own |

Displays if a State e-file you're trying to produce requires you to select the Federal also, but you can’t select the associated Federal e-file because it has its own problem(s). To correct the error, you must first resolve the problems listed under the Federal option. |

|

At least one of the following e-file types is required to select this e-file... |

Displays if a State e-file requires you to select the Federal also, but you don’t have the appropriate Federal forms in your return. A list of appropriate e-file types would be displayed. To correct the error, add one of the forms to your return. |

|

Form X is required to e-file Form Y and will be selected automatically |

Indicates that certain forms are prerequisites for other forms. The system will automatically select prerequisite forms if they are available. |

See Also: